Note: This article first appeared in the October edition of Top Sales Magazine.

There are few alternatives to growth for most companies. It’s the rare firm whose goal involves getting smaller and, for employees, there is a strong correlation between their company’s growth rate, promotion opportunities, and job satisfaction.

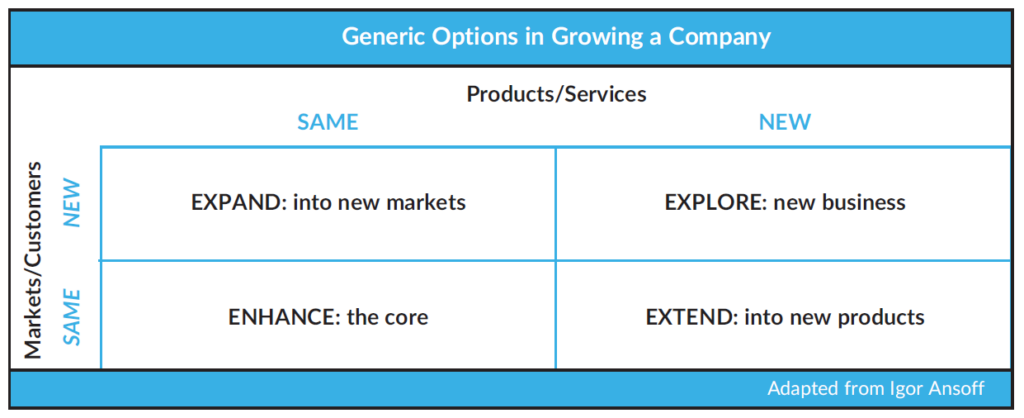

But a growth strategy must be intentional, clarifying where the growth will come from and what it requires in terms of business development. A simple matrix, developed years ago by Igor Ansoff in his book Corporate Strategy, helps to clarify generic growth options for most firms.

Ansoff’s point was that growth scenarios generally involve selling the same products to current or new customer segments, or selling new products to current or new customers. My point is that the options have different implications for sales tasks and capabilities.

In the upper-left quadrant, a company expands into new markets or segments with the same products. An example is when SaaS firms focused on SMB customers seek enterprise accounts. The same software sold to SMB accounts on a product performance and ROI basis must now be integrated into the Enterprise customer’s IT systems and established protocols across functions. Business development means gaining access to decision makers and selling workflow changes, not only a better product.

In the lowerleft quadrant, growth involves enhancing the core by leveraging what you do in current markets with current products. Here, important tasks typically involve crossselling, initiatives to increase repeat purchases, ongoing account management skills, and training in price negotiations so that a “valueadded bundle” is not just your sales force’s euphemism for a discount.

In the upper-right quadrant, growth means selling new products to new customers. Capabilities include expertise in customer selection, coordination between sales and product managers for applications development, and disseminating learning about what does and doesn’t work in new segments. Market research studies and focus groups help. But onsite visits offer the ability to understand the new usage context at the customer, not at your lab, office, or website. Training should provide reps with these skills in customer discovery.

Finally, in the lowerright quadrant, growth means increasing shareofspend at current customers with new products or addon services. This approach often means the ability to leverage reps’ existing account relationships in order to get positive access to buyers at other departments or functions of current accounts, teamselling initiatives, and perhaps a different compensation plan. These are not mutually exclusive growth options, but each has different implications for sales tasks and behaviors. You cannot separate sales effectiveness from strategic choices and, when a company does not pay attention to these differences, the sales force is basically being told to “go forth and multiply” without the relevant training and skills. That’s a random bet, not strategy implementation.