Frank V. Cespedes, for Top Sales Magazine, August 2017

There is lots of buzz about big-data and “Sales Enablement” (SE)—the current catch-all term for attempts to increase sales productivity via technology. There are now hundreds of vendors of such tools, and SE is increasingly a formal position in more companies. The interest is driven by multiple factors.

One is the declining costs of the technology. Also, many SE tools utilize established CRM platforms and are therefore an incremental investment resting on the sunk costs of an extant CRM system. A second reason is a change in cost structures spurred by the financial crisis. S&P-500 companies, for example, have decreased their COGS by over 250 basis points in the 21st century.[1] In the aggregate, that’s a lot. But SG&A and selling costs have not decreased. The result is a shift in the focus of productivity improvements. Companies have in fact done a good job in managing back-office costs, supply chains, and infrastructure. The next frontier is their go-to-market costs because (as the bank robber said when asked why he robs banks) “that’s where the money is.”

A third reason is that selling is increasingly data-hungry work in many markets. To see big-data analytics in action, don’t just go to Facebook or Google. Look at what consumer goods salespeople must now do to get shelf space, develop promotions, and garner in-store support at retailers. Similarly, you might assume that wholesale distribution, where firms resell products manufactured by others, is a simple transaction sale. But a study for the National Association of Wholesaler-Distributors[2] finds the same need for analytical selling skills in this sector—in large part because transactional sales migrate to the web. In general, personal selling is looking more like a research-based as well as persuasive activity.

There are, therefore, compelling reasons why SE merits attention. A recent survey of more than 1000 companies[3] indicates the top areas where these tools are currently deployed: lead generation and lead scoring; pipeline management and forecasting; and helping to identify cross-sell and up-sell opportunities at current customers by trolling thru buying histories.

However, these analytics are a pre-requisite to improving productivity. Reporting that the pipeline grew by so many dollars is not managerially meaningful by itself if the firm is serious about profitable growth. How did the pipeline grow? Did we add lower- or higher-profit customers? Are we bringing in shorter- or longer-selling-cycle prospects? What are the implications for other functions and the center of gravity in our business strategy? You can’t substitute data for management. And you can’t manage sales effectively unless you have a framework for diagnosing sales productivity in your business.

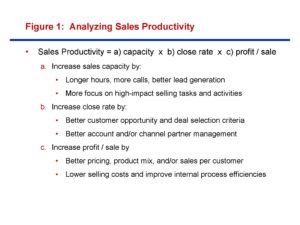

Here is a starting point (see Figure 1: Sales Productivity = Capacity x Close Rate x Profit/Sale). The productivity of a sales model is a function of capacity (how much the sales force can do in terms of call capacity and their capacity, or capability, to reach target customers), the close rate (what percentage of prospects the sales force sells), and profit per sale (what they sell and at what prices). What levers are available to sales leaders to improve each component and how can SE help?

To improve sales capacity, people can work harder: generate more leads and make more calls. New tools provide a window on what, historically, has been opaque in many firms: call patterns, the amount of time reps spend in selling activities, and their persistence. Data indicate, for example, that in most inside sales efforts, it takes 6-8 calls to make customer contact, but most inside reps stop after 3-4 calls. You also improve capacity by working smarter: focusing on the high-impact sales tasks inherent in your strategy and so increasing the odds that customer contact will be more productive. For example, studies indicate that marketing departments spend about 25% of their budgets on sales collateral, but as much as 70% of marketing content is never used by sales reps.[4] Tools from companies like DocSend and Showpad enable firms to track what reps do use, what they send to prospects, and what prospects do and don’t pay attention to. In turn, this data can allow both marketing and reps to work smarter.

To increase close rates and accelerate selling cycles, get better at identifying the different types of customers that confront most firms. Which are solution customers where customization is required and worth it? Which are transaction customers where the issue is to take costs out of your sales approach? Tools from firms like LevelEleven and Pipeliner help to track leading indicators relevant to these distinctions, and so provide a basis for smart managers to address those buying-behavior differences in their sales metrics, account management policies, and channel-partner decisions.

To improve profit per sale, constantly work on basics that go beyond the sales force: e.g., production, product mix, and pricing. You also improve profit per sale by lowering irrelevant selling costs. In too many firms, standard practice is still indiscriminate across-the-board cuts when volume stalls or declines. The result is often a self-fulfilling downward spiral. Perhaps the greatest impact of SE is its ability to help managers to lower selling costs without harming selling, because the tools help them know where and where not to cut, increasing selling time and resources for the key sales tasks.

Every strategy has an implied sales productivity equation. For some firms, capacity, close rates, and profit per sale involve many pre-sale and post-sale activities. Think about enterprise software and many professional services. For others, this equation can be a single sales call. Think about old-time door-to-door selling or current inside sales for many B2C and B2B goods. For both types, this framework can help a sales leader track best practices in the business and improve via smart use of the available technology. And note the cause-and-effect: SE can provide data, but it’s managers who make good use of it. As usual in business, the core drivers are people and management, not technology.

REFERENCES

[1] “Five Ways CFOs Can Make Cost Cuts Stick,” McKinsey Quarterly (May 2010).

[2] “Transforming Wholesale Distribution Sales Teams to Thrive in the New Economy,” a study by the NAW and Chally Group (2016).

[3] “Unlocking the Power of Data in Sales,” McKinsey Quarterly (December 2016).

[4] See the data in “The Sales Lead Black Hole,” Journal of Marketing (January 2013), and in the report from Sirius Decisions, https://www.siriusdecisions.com/Blog/2013/May/Summit-2013-Highlights-Inciting-a-BtoB-Content-Revoloution.aspx.

Frank Cespedes teaches at Harvard Business School and is the author most recently of Aligning Strategy and Sales (Harvard Business Review Press).

FIGURE 1.