Business is more complex, data more abundant, and more specialists are needed to stay up-to-date with functional best practices. As a senior executive, you can worry all you want about disruption, but you need a salesforce aligned with strategy to do something about it.

There have been big changes in the C-Suite of companies globally. The number of executives reporting to the CEO has doubled in recent years, mostly an increase in functional specialists like CIOs and CMOs, not general managers responsible for cross-functional integration.1 Meanwhile, the number of Fortune-500 and S&P-500 companies with COOs has decreased to about 35%.2 Three decades ago, COOs outnumbered CFOs in those firms, not now. Business is more complex, data more abundant, and more specialists are needed to stay up-to-date with functional best practices.

These changes affect a core task of a CEO and other senior executives – the formulation and implementation of strategy – and the aggregate results have not been good. Consider:

• Surveys indicate that in most firms less than 50% of employees say they understand their firm’s strategy, and that percentage decreasesthe closer you get to the customer in responses from sales and service employees.3 It’s tough for people to implement what they don’t understand.

• Even worse: In a McKinsey survey of 772 directors, only 34% believed their boards comprehended their companies’ strategies.4

• Almost 3-of-5 senior executives (56%) say their biggest challenges are ensuring that daily decisions align with strategy and allocating resources in ways that support their company’s strategy.5

• The result is a performance gap: firms realise only about 50-60% of the financial return their strategies and sales forecasts promise.6 That’s a lot of wasted time, money, and managerial effort.

What must senior executives do to address this gap? They should start with a closer look at Sales. US firms alone spend about $900 billion annually on sales. That’s more than 3x their total ad spend, more than 20x their spending on digital marketing, and more than 40x their current spend on social media. Selling is, by far, the most expensive part of strategy execution for most firms. At a minimum, the C-Suite must manage the following cornerstones for organic growth:

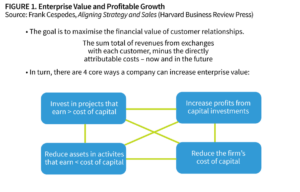

Linking Customer Value and Profitable Growth. The goal of strategy is profitable growth, meaning economic value above the firm’s cost of capital. As Figure 1 indicates, there are basically four ways to create enterprise value: (1) invest in projects that earn more than their cost of capital; (2) increase profits from existing capital investments; (3) reduce assets devoted to activities that earn less than their cost of capital; and (4) reduce the cost of capital itself. In my experience, relatively few senior executives understand and operationalise the sales factors that affect each value lever:

• In most firms, the bulk of capital expenditures is driven by revenue-seeking activities with customers. Hence, the call criteria used in sales directly impact the first value-creation lever: which projects the firm invests in. Yet, how many in the C-Suite understand how compensation, deployment and other core sales management practices determine these criteria daily?

• Increasing profits from existing investments requires productivity improvements. In the past 15 years, production efficiencies enabled an average S&P-500 company to reduce its cost of goods sold by about 250 basis points – a big improvement. But selling expenses as a percentage of revenue have not declined.7 Where would you look next for a source of competitive advantage?

• Reducing assets devoted to negative-return activities requires good links with changing market realities and an understanding of how hiring, development, and performance metrics affect field behaviour. Without that understanding, asset redeployment becomes either an exercise that does not really affect behaviour – the “reorganisation merry-go-round”, as cynics put it – or an unwitting impediment to the use of assets that in fact remain essential to effective selling.

• It may seem that sales has little impact on the firm’s cost of capital. But consider the basics: financing needs are driven by the cash on hand and the working capital required to conduct and grow the business. Most often, the single biggest driver of cash-out and cash-in is the selling cycle. Accounts payables are accumulated during selling, and accounts receivables are largely determined by what’s sold, how fast, and at what price. That’s why increasing close rates and accelerating selling cycles is a strategic as well as sales issue.

Customer interactions affect all elements of enterprise value and, in many firms, the sales force is the origin and sum of those interactions. Strategy, growth, or attempts to increase the stock price or valuation without attention to this fact are at best limited and, at worst, going down the wrong path.

Strategic Planning Processes. According to surveys, about two-thirds of companies treat planning as an annual event, and the average corporate planning process now takes 4-5 months, typically as a precursor to the annual budgeting process. But sales must respond customer by customer in external market time, not internal planning time. In other words, even if the output of planning is a great strategy (clearly, a big if), the process itself often makes it irrelevant to daily customer-contact activities.

In many firms, moreover, the means for introducing and reviewing business plans exacerbates the separation of the C-Suite from sales. The typical approach is a kick-off meeting followed by a string of emails from headquarters with periodic reports back to headquarters on sales results. Each communication is one way, and there is too little of it. One result is that root causes of under-performance are often hidden from both groups.

A basic fact of business is that value is created or destroyed with customers. Hence, strategy is about confronting evolving market realities and their customer-contact requirements. Senior executives cannot do that solely through plans and big-data analytics. Good leaders know that interpreting market data is not just a search for truth and insights. It’s also about actionable dialogue with the people, especially sales people, who must use that data where value is created or destroyed.

Hiring and Development. Senior executives now routinely talk about talent management, but few deal systematically with these numbers: across industries, average annual turnover in sales is 25-30%. This means that in many companies the equivalent of the entire sales organisation must be hired and trained every four years or so. The challenge is compounded by the fact that there is no easily identified resource pool for sales positions. Of the over 4,000 colleges in the United States, less than 100 have sales programs or even sales courses. The situation is similar in Europe. And even if companies find qualified graduates, the increased data and analytical tasks facing many sales forces mean that productivity ramp-up times have increased. Each hire is now a bigger sunk cost for a longer time.

Companies typically spend more on hiring in sales than anywhere else in the firm, and it is leadership’s responsibility to keep relevant a resource allocation of that magnitude. The forces reshaping C-Suites are also changing sales tasks. As firms confront new buying processes driven by online technologies, required selling skills are changing. Figure 2, based on an extensive database of company sales profiles, indicates the changing nature of sales competencies at many firms.8 Competencies that, only a decade ago, were considered essential are now lower in priority. Yesterday’s sales strengths have become today’s minimum skill requirements.

This underscores the need for on-going talent assessments in sales roles, not just “at the top”. The tools for doing such assessments are more available and have more granularity. For many sales organisations, these tools are a big improvement over the standard mix of folklore, various embedded biases based on “how we’ve always done it here”, and glib generalisations about “core competencies” that often dominate C-Suite discussions about growth. It’s said that many companies maintain their equipment better than their people. If so, then in sales you will ultimately get what you don’t maintain.

These changing sales competencies also emphasise a competitive reality: markets have no responsibility to be nice to any firm’s strategy and legacy competencies. It’s leadership’s responsibility to adapt to the market as it operates today, not yesterday. As a senior executive, you can worry all you want about disruption, but you need a salesforce aligned with strategy to do something about it. Conversely, senior executives who talk about “leadership development” but ignore this aspect of development are just talking.

It indeed starts at the top. Reflecting on his experience as a CEO, Louis Gerstner put it well: “I came to see [that] culture isn’t just one aspect of the game – it is the game. In the end, an organization is nothing more than the collective capacity of its people to create value.”9 Because of sales’ central role with customers, changes in sales requirements always have wider implications which affect that collective capacity. Today, those changes are at the heart of many challenges and opportunities confronting firms: how to harness big-data technologies; how to respond to altered buying processes as customers utilise online channels of information; how to develop talent that can respond flexibly but coherently; how to encourage cross-functional efforts without destroying necessary expertise and accountability. Senior executives who do not remain engaged with these sales issues will inevitably share the fate of companies where “customer focus” is a perennial slogan but not an organisational reality. As I once heard a CEO tell his leadership team, “There ain’t many customers at headquarters!”

Sources: Frank V. Cespedes, What Senior Executives Should Know About Sales,” European Business Review (September/October, 2016)