Interview, “Frank Cespedes: The Role of the Sales Force in Pricing Strategy Implementation” [Chapter 4 of Pricing Strategy Implementation: Translating Pricing Strategy into Results, ed. Andreas Hinterhuber and Stephan M. Liozu; Routledge, 2020]

- What are key capabilities for the sales manager/SAM in the future vs today?

Selling, sales management, and account management requirements are changing—quickly and with implications for other functions and activities in companies—but not in ways typically discussed in the business press and many popular sales books.

For example, it is not true that salespeople are being “disintermediated” or replaced by online interactions. In the United States, the internet has been a fact for nearly 30 years. Yet, according to U.S. Bureau of Labor Statistics (BLS), the number of salespeople in the U.S. has increased in the 21st century to more than 10% of the labor force.[1] Further, the BLS data almost certainly undercounts the reality because, in increasingly service economies like those in the U.S., Europe, and other places, business developersare often called Associates, Managing Directors, or Vice Presidents, not placed in a “sales” category for labor-department reporting purposes. But selling is what they do.

Similarly, ecommerce has been there since the introduction of the internet. Yet, after decades, only 11.4% of total retail sales in the U.S. in 2019 were online sales. That figure includes Amazon, and almost half of the non-Amazon portion of ecommerce is via the online sites of brick-and-mortar retailers. Even if this online percentage doubles, or triples, in the next decade the majority of retail sales is still done in stores.

U.S. companies spend, annually, on their sales efforts more than three times what they spend on all of their media advertising, and more than 10 times what they spend on social media and all other digital marketing initiatives. Selling expenses and the sales force are, by far, the most expensive part of strategy execution for most firms.

What is changing is the nature of sales tasks. Consider the process of buying a car. Consumers do a lot of online research: the average U.S. car shopper now spends over 11 hours online and only about 3.5 hours offline in trips to dealerships during their buying journeys. But the vast majority of consumers still purchase their cars in-person at a dealer. Further, research indicates that their online sources of information have made consumers place more emphasis on their interactions at the dealer with salespeople. However, becausebuyers can access prices, reviews and other information via online searches, their attitudes toward negotiations, list prices, and sales behavior at dealers are changing. Smart phones, market forums, and other factors are causing similar changes across many other industries, both B2B as well as B2C.[2]

The most important thing about selling is the buyer. Changes in buying behavior are affecting the capabilities needed by sales managers and SAMs. Rather than moving sequentially through a funnel, buyers (like auto shoppers) now typically engage in parallel activity streams throughout their buying journey. Understanding where prospects and customers are, how they move between streams, and how to interact with them in a given stream, is now central to effective selling, sales management, and the implementation of a pricing strategy.

- Pricing and sales: what is your experience in delegating pricing authority to sales/SAMs? Under which circumstances would you expand/restrict pricing authority? e.g. type of product (complex solutions vs commodity type; type of customer; etc.)?

Where pricing authority resides depends a lot upon context and the buying process. But let’s first consider a pre-requisite for even considering delegation of pricing authority to sales: having in place a relevant and coherent sales compensation plan.

Compensation is perhaps the most discussed aspect of sales management—even though research indicates that coaching, reviews and other performance-management practices typically have more impact on actual selling behaviors. Surveys consistently indicate that, across industries, about 65-75% of firms set sales incentives on the basis of volume—i.e., how much is sold irrespective of the price, margin, or cost-to-serve customers.

In an incentive plan like that, the message to salespeople is, sell to anyone because there is no such thing as a “bad” customer; and reps will, rationally, discount price to make the sale and make quota. This mis-alignment is not hard to understand intellectually. But many companies still do this.

As a result, industries are filled with companies that get what they pay for (e.g., sales people who, responding to their volume-driven incentives, fail to execute a premium-priced strategy), and don’t get what they don’t pay for (e.g., individually focused incentives for SAMs who must work with others in a team-selling approach to key, multi-location accounts). So the first step in potentially delegating pricing authority is to make sure your sales incentive plan encourages the behavior you need.

Second, it’s important to distinguish between a price and pricing. Competition, supply and demand, other market factors, and—by voting with their feet—customers determine what they will pay in terms of price. In a given context, sales people may or may not possess the best local knowledge to help negotiate that price with specific customers. But it’s the selling company’s responsibility to set pricing—i.e., the structure of prices for a given product-service configuration. A price is not the same as pricing. Customers ultimately determine price. But you and your company do pricing, including the framing and delivery of the value proposition.

Then, whether or not sales people should have significant pricing authority depends, in my view, more about buying processes than product type. There are successful and unsuccessful examples of centralized and decentralized pricing in both commodity and specialty product categories. The more relevant variables are who buys and how, not what they buy.

Historically, many firms delegated price authority to individual salespeople because the time required for sales to get pricing approval from headquarters, their managers, or a centralized pricing office was long and cumbersome. Technology is fast overcoming that constraint. But any process—including pricing—is only as good as the people who manage that process.

- Any examples of best-in-class companies in pricing strategy implementation?

Best practices in pricing vary by type of business, stage of business, and competitive context. Market forces can soon make today’s example of “best in class” tomorrow’s case study about marketing myopia. That said, I would cite as long-term good examples of pricing implementation Apple for tangible tech products, Disney in B2C, Paccar in B2B, Louis Vuitton in luxury goods, and some SaaS firms about whom I teach case studies in my courses at Harvard Business School.

In my experience, however, a key issue in effective pricing implementation is understanding the role and goal of price in your particular business model. The role of price, and therefore what constitutes best practice in price implementation, varies significantly depending upon (for example) whether the company is involved in project pricing, product pricing, the pricing of a product/service package, or seeking an early-mover advantage where (in theory at least) we initially sell low with profitable monetization coming later by up-selling the installed base.

These are very different pricing roles and, as always, the specific buying-behavior context is crucial. Consider, for example, consumer internet companies and the currently fashionable “freemium” pricing approach. The common business model here is a two-sided platform with a chicken-and-egg dynamic: you must attract users in order to attract consumers or firms willing to use your site and pay to advertise on your site. Hence, to sign up users and build that part of the platform, initial “free” pricing to consumers is common.

This sounds plausible because there’s typically almost no or very low marginal costs to digital goods. So the plan is to acquire users with free services until inertia or switching costs kick in and then you charge for additional capacity, extras, or premium features. It seems to have worked beautifully for companies like Dropbox, LinkedIn, and Skype. But so many other freemium pricing companies have basically enacted the old joke about selling each pencil below cost while hoping to make it up in volume. Why?

Usually, only 1-2% of users will upgrade to a paid product. Therefore, the size of the target market counts in adopting this pricing approach. Choice of features for free, and managing a built-in tension, are important implementation issues in this approach: offer too many features and there’s no incentive to upgrade (the plague of most current SaaS businesses); but offer too few and you cannot generate enough initial users to make your site attractive to advertisers or others on the other side of the platform. The product/customer context matters. Note the dynamics of services like Atlassian or Basecamp (collaborative software), Dropbox (cloud sharing files), LinkedIn, and Skype: in part you sign-up for and use these services because other important people in your life (colleagues, prospective employers, friends, family) use them. The presence or absence of peer pressure and social switching costs are often the foundation for the success of this pricing approach.

Therefore, my counsel to executives is to be wary of trying to use someone else’s ‘secret sauce’ in the recipe of their business model. Best practice is what works here, not there.

- How should companies start this journey?

“Journey” is the right word because, in a competitive market, effective pricing is a process, not a one-and-done analytical study of willingness-to-pay. The journey starts with identifying customer value and it requires ongoing price testing to make sure we are still travelling in the right direction as market conditions inevitably change.

In my MBA and executive courses, I often assign a note about pricing which (among other things) discusses a company called Zolam (disguised name). Zolam is a chemical firm serving diverse global markets characterized at the time by declining demand, industry over-capacity, and capital market pressures to increase earnings. Not a happy situation. Zolam initially responded by stressing new technology complemented by product-line cuts, reduced inventory and service levels and other cost-cutting moves. But these moves did not appreciably improve earnings. Zolam’s leadership eventually focused on pricing as a way to win profitable business.

Zolam leaders started with a consistent message: “We must understand what is valuable in order to be valuable.” In meetings across functions, they repeatedly asked how specific product, service, or other benefits impacted customers including, but not limited to, their customers’ financial success. Buying decisions always have at least two dimensions: the benefits customers value, and how they buy. Zolam’s customers included firms that package pharmaceuticals and to whom it sold rubber stoppers used to cap injectable drugs–a product long viewed as a low-price “commodity.” But Zolam found a hierarchy of benefits in this simple product.

The base level was to minimize customer acquisition costs of the stopper. The next level was to reduce possession and usage costs through design and delivery initiatives that increased customers’ packaging line speeds, lowered their inventory requirements, and aided their manufacturing capacity planning. A third level was to help customers increase their product’s performance. Zolam found, for instance, that stoppers molded in unique colors helped hospitals and doctors reduce errors and lower insurance costs, yielding a higher price for Zolam’s packaging customers and less churn in their customer base.

Adopting this value-based approach across its product line, Zolam developed metrics, customer profiles, and new account-review processes for its salespeople. Different customers, or the same customer at different times, had different purchasing criteria and price elasticities, depending upon the usage application. This approach and the consequent data and testing allowed Zolam to clarify target price, reservation price, and the price negotiation strategy relevant in a given buying context. In turn, salespeople were trained and incentivized in line with this approach, which generally meant calling on different people at different organizational levels within their assigned accounts.

Then, you must credibly communicate the value being delivered. Zolam did this through frequent reviews, after the sale, with key people at targeted accounts. In other businesses, however, it’s important to find ways of doing this before the sale. A good example is Paccar, maker of trucks which Paccar sells for about a 20% price premium versus its competitors. Paccar salespeople qualify customers with an online interactive detailing of expenses incurred during the life of a truck, with data supplied by the prospect. You can input gasoline costs, tire rolling coefficients, and vehicle weights to quantify the benefits of a Paccar truck versus lower-priced alternatives. You can do the same for resale value, maintenance, driver retention (useful data if you run a fleet), and financing costs. The firm’s website also provides a fuel-economy primer aptly titled “Push Less Air, Pull More Profit.”

- Let us get down to the individual sales manager/SAM. What are in your view characteristics – i.e. personality traits – of sales managers/SAMs that excel in pricing strategy implementation? What are, by contrast, personality traits or behavioral characteristics that make the individual SAM less effective?

Popular sales methodology books, and many sales training firms, focus on personality traits. However, most of these assessments read like a horoscope (“can listen but challenge”), or like a bland summary of traits like “modesty, conscientiousness, curiosity, an achievement orientation, lack of discouragement,” and so on. At best, these lists of personality traits remind us that people tend to do business with people they like, or that certain basics of human interactions (listen, don’t interrupt, make sure you understand the other person’s perspective, etc.) are relevant in most sales contexts.

But the search for personality traits in effective selling, including pricing implementation, is fundamentally flawed. Research about the links between personality traits and selling effectiveness has been conducted for nearly a century. The results are inconsistent and, in most cases, contradictory and not replicable—that is, study X asserts a positive correlation between certain personality traits and sales performance, and study Y finds in a different context a negative correlation.

These inconsistent results tell us something: so much depends on the buying situation that what academic researchers call a “contingency approach” is necessary. More simply stated, the research suggests that common stereotypes of a “good” sales person (e.g., pleasing personality, deep inventory of stories, hard-wired for sociability, and so on) are indeed just stereotypes. Sales talent—and sales failure—come in all shapes and sizes. No size fits all.

Here is how I think of the traits and characteristics relevant to sales and pricing effectiveness:

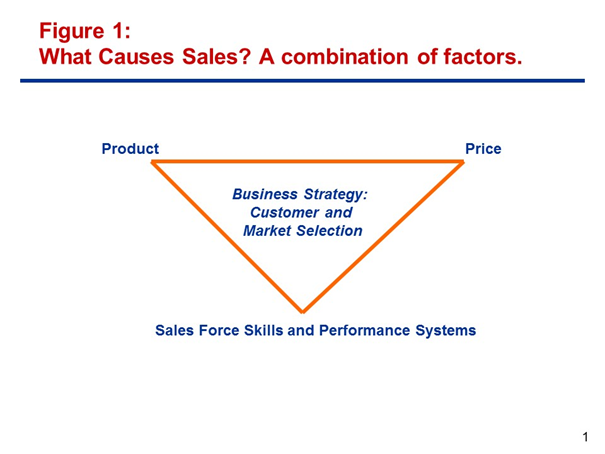

First, recognize that multiple factors cause sales, including—but not limited to—price, the skills of the salesperson, and the quality and relevance of the product being sold at a given price. Another important factor is customer selection or what the strategy literature calls the “scope” of the business—i.e., decisions that companies are always making, implicitly or explicitly, about where they do and do not focus in a market. See Figure 1.

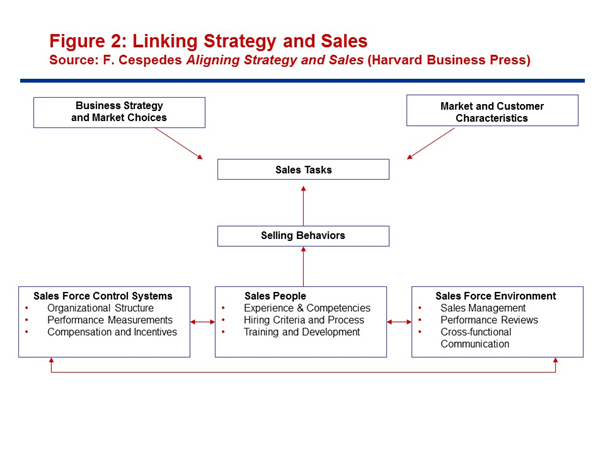

Second, then understand the key sales tasks in that business. See Figure 2. To do this, always start with the externals in your business, not internal price lists. Value in any business is created or destroyed in the marketplace with customers, not in conference rooms or research studies. Key externals include the industry you compete in, the market and product segments where you choose to play, and the nature of the buying criteria at the customers you target. These factors determine the required sales tasks—that is, what your go-to-market initiatives must accomplish to deliver and extract value via your pricing approach, and therefore what your salespeople must be good at to implement your approach effectively.

Then, the issue is aligning actual selling behaviors (including pricing) with the required sales tasks and using the appropriate levers for doing that. The key levers in most businesses are displayed along the bottom of Figure 2:

Salespeople: who they are, what they know, how you hire and then develop their skills and attitudes over time, so that they are good at executing your firm’s required sales tasks, not those of a generic selling methodology or what they learned at another company that made a different set of strategic and pricing choices.

Sales Control Systems: the systems that shape ongoing performance management practices, including how the sales force is organized, key performance indicators (e.g., volume? margin? profit-per-sale? other?) used to measure sales effectiveness, and sales compensation and incentive systems.

Sales Force Environment: the wider organizational environment in which pricing and other go-to-market initiatives are developed and executed; how communication does or doesn’t work across organizational boundaries (e.g., between Product and Sales groups in the firm); how sales managers are selected and developed; the conduct of performance reviews.

Selling effectiveness is not a generalized trait. It’s a function of the specific sales tasks. Therefore, the relevant personality is the personality, and skills, that are relevant for those tasks in that market for that selling company.

I believe the same is true when it comes to personality and pricing. In a transactions-intensive, inside sales model where the pricing is part of a land-and-expand sales approach with accounts, you almost certainly want a different type of customer-contact person than you do in a longer selling cycle, product/service solutions model where up-front pricing requires effective framing and articulation of a more complex value proposition. My view is that managers should start with understanding the relevant sales tasks, not an elusive search for a set of all-purpose personality traits.

- What other pieces of advice do you have for companies that struggle in getting pricing/value creation strategies implemented?

Based on my experience with companies, I’ll offer three final pieces of advice:

“Everyone else does it this way.” Avoid this mindset. Pricing is a visible moment-of-truth in business, and many managers take refuge in the herd—i.e., “established” industry practice. But the essence of strategy is being smart about being different. Pricing is where you test the coherence of a business strategy and value proposition. Herd pricing also runs the risk that prices are the legacy of obsolete market circumstances and sales tasks in that industry.

Cost-based pricing is easier to explain. Evidence supports this intuition. Behavioral researchers have charted a phenomenon across countries, cultures, and economic systems: people in Communist countries reacted to various cost-based pricing scenarios in ways not very different than people in Beverly Hills. But when you are providing differentiated value, the issue is framing price appropriately.

At the gas pump, the credit price is typically the default price, while paying by cash garners a “discount.” Over a century ago, Marshall Field pioneered the concept of the retail bargain basement. As a place for slow-moving or out-of-fashion goods from upstairs, the basement helped keep higher-margin offerings on the main levels and, by relegating specific products downstairs, buyers from each department freed up shelf space for faster-turning items. Customers did not object; they bought. Few customers wake up in the morning wanting to pay a higher price. But most seek value.

Price Testing. Price is a dynamic variable in any business, affected by changes over the product life cycle or as a company seeks to move from early adopters to more mainstream customer segments. Hence, testing prices as buyers and buying behavior changes is crucial. But relatively few companies do that. Or, they rely primarily on surveys and there are systematic differences between how people respond to surveys and their actual behavior in the marketplace.

Admittedly, testing price in a business context presents challenges that are qualitatively different from the circumstances surrounding academic market research or clinical trials. There are relatively few opportunities for randomized controlled experiments in a changing, competitive market. But increased access to data, new technologies for A/B tests, the ability to change prices online, or run online ads with different prices at different times, are all making price testing more accessible. There is less excuse not to test prices on an ongoing basis. As usual in business, the real constraint is managerial.

- Frank Cespedes teaches at Harvard Business School. He ran a professional services firm for 12 years, has consulted to companies in many industries, and has been a Board member of start-up firms, established companies, and private equity organizations. He has written for numerous publications, and is the author of six books including Aligning Strategy and Sales (Harvard Business Review Press, 2014) which was cited as “the best sales book of the year” (Strategy & Business), “a must read” (Gartner), and “perhaps the best sales book ever” (Forbes) and Sales Management That Works: How to Sell in a World That Never Stops Changing (Harvard Business Review Press, 2021)

Graphics

ENDNOTES

[1] See the BLS website for sales employment: https://www.bls.gov/oes/current/oes410000.htm.

[2] For data about auto buying, see Frank V. Cespedes and Jared Hamilton, “Selling to Customers Who Do Their Homework Online,” Harvard Business Review (HBR.org March 16, 2016). For data about buying and sales interactions across a variety of other industries, see Frank V. Cespedes and Tiffani Bova, “What Salespeople Need to Know About the New B2B Landscape,” Harvard Business Review (HBR.org August 5, 2015).